How Life Insurance Works

Life insurance works by providing a death benefit to the beneficiaries designated in the policy upon the insured person’s death. Here’s a general overview of how life insurance works:

- Selecting a Policy: The policyholder selects the type of life insurance policy based on their needs and preferences. This includes choosing between term life insurance (coverage for a specific term) or permanent life insurance (coverage for the entire lifetime) and determining the coverage amount.

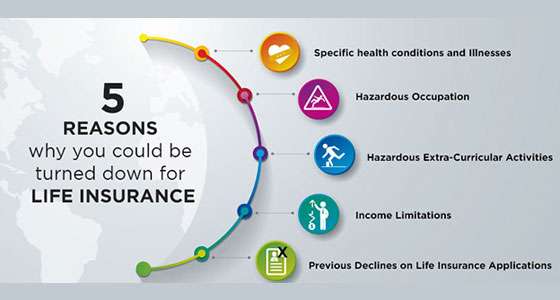

- Application and Underwriting: The policyholder applies for life insurance by completing an application form and providing information about their age, health, lifestyle, occupation, and other relevant details. The insurance company assesses the risk associated with insuring the individual through a process called underwriting. This evaluation helps determine the premium rates and whether the policy will be issued.

- Premium Payments: Once the policy is approved, the policyholder pays regular premiums to the insurance company to keep the policy in force. Premiums can be paid monthly, quarterly, annually, or according to the terms specified in the policy. The premium amount is determined based on various factors, including the insured person’s age, health, coverage amount, and policy type.

- Death Benefit: In the event of the insured person’s death, the beneficiaries named in the policy are entitled to receive the death benefit. The death benefit is the sum of money specified in the policy and is typically paid out as a tax-free lump sum. The beneficiaries can use this amount to meet financial obligations, such as funeral expenses, debts, mortgage payments, or any other financial needs.

- Policy Riders and Options: Some life insurance policies offer additional features called riders or options. These can be added to the base policy for an extra cost and provide benefits beyond the basic death benefit. Common riders include accelerated death benefit riders (allowing the insured person to access a portion of the death benefit if diagnosed with a terminal illness), waiver of premium riders (waiving premiums if the insured person becomes disabled), or additional coverage for specific circumstances.

- Cash Value (in Permanent Life Insurance): Permanent life insurance policies, such as whole life or universal life insurance, may include a cash value component. A portion of the premiums paid accumulates in a cash value account, which grows tax-deferred over time. The policyholder may have the option to access the cash value during their lifetime through policy loans or withdrawals.

Example :-

Based on the assumptions provided, let’s modify the calculations for the annual loss due to deaths:

Number of Persons: 5000 Number of persons dying in a year: 25 Economic value of loss suffered by the family of each dying person: Rs. 2,00,000/-

To calculate the total annual loss due to deaths, we can multiply the number of persons dying i

- n a year by the economic value of loss per person:

Total annual loss due to deaths = Number of persons dying in a year * Economic value of loss per person = 25 * Rs. 2,00,000/- = Rs. 50,00,000/-

The procedure for the insurance contributions and payouts:

- Calculation of Total Value of the Fund:

-

- Number of Persons: 5000

- Contribution per Person: Rs. 1200/-

Total Value of the Fund: Number of Persons * Contribution per Person = 5000 * Rs. 1200/- = Rs. 60,00,000/-

-

- Calculation of Payout per Person:

- Number of persons dying in a year: 25

- Insurance Company Payout per Person: Rs. 2,00,000/-

- Total Payout per Year: Number of persons dying in a year * Insurance Company Payo

ut per Person = 25 * Rs. 2,00,000/- = Rs. 50,00,000/-

Calculation to determine the impact on the fund after the payouts:

- Calculation of Remaining Fund:

- Remaining Fund after Payout: Total Value of the Fund – Total Payout per Year = Rs. 60,00,000 – Rs. 50,00,000 = Rs. 10,00,000/-

- Therefore, after paying out Rs. 50,00,000/- to the families of the 25 deceased persons, the remaining fund is Rs. 10,00,000/-.

It’s important to note that this simplified calculation assumes a constant number of deaths per year and does not consider factors such as interest, administrative costs, or changes in the number of contributors. In real-life scenarios, insurance calculations involve more complex considerations and actuarial principles to ensure sustainable coverage and fund management.